Before you pack your bags, it’s important to think about travel insurance. Bali is no exception.

In this guide, you’ll find out why you might need travel insurance for Bali and what type of coverage to look for. We’ll also explain the pros and cons of basic versus comprehensive policies.

Is travel insurance mandatory for Bali?

Currently, travel insurance is not mandatory for entry into Bali. As an Indonesian island, you are free to visit Bali without insurance if you choose.

That said, going with travel insurance to Bali is highly recommended. This can protect you against unforeseen circumstances** that could disrupt your holiday.

While travel insurance is not an obligation, remember that the Bali Tourist Levy is. Learn how to pay this tax here.

Why do you need travel insurance for Bali?

Travel insurance is not a legal requirement. However, there are several good reasons why you should consider it:

1. Medical emergencies

Healthcare in Bali can be expensive, especially for emergency treatments. If you need to visit a hospital for an accident or illness, having insurance guarantees that you can receive proper medical care.

2. Accidents during activities

Bali is perfect for outdoor activities like surfing, diving, and hiking. However, these come with risks. If you plan to take part, consider insurance that covers sports-related injuries.

3. Trip cancellations and delays

Travel can be unpredictable. Flights can get delayed. Natural disasters could occur. Insurance can help cover the costs of cancellations or extra accommodation.

4. Theft and loss of belongings

Tourist destinations can sometimes attract pickpockets and thieves. Travel insurance can refund you the cost of lost or stolen items.

What should travel insurance for Bali cover?

Make sure you choose the right type of travel insurance for you. Your policy should cover:

- Medical emergencies, medications, and repatriation if necessary.

- Adventure activities and related injuries.

- Trip cancellation or delay

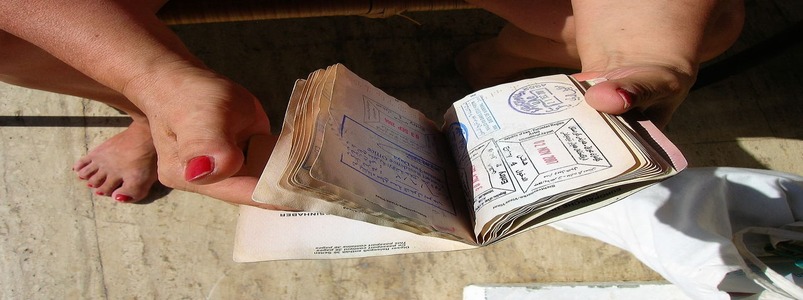

- Lost, damaged, or stolen personal belongings (including travel documents)

Pros and cons of basic vs. comprehensive insurance for Bali

Travel insurance is typically divided into two categories: basic and comprehensive. Here’s an overview of the pros and cons of each option for Bali travel.

Basic travel insurance

| Pros: | Cons: |

|---|---|

|

Cost-effective: Basic policies are usually cheaper and cover essential areas such as medical emergencies. Suitable for short trips: If you're only staying for a short time and not participating in high-risk activities, a basic plan is probably enough. |

Limited coverage: Basic policies may not cover adventure activities, trip cancellations, or theft. Higher out-of-pocket costs: If something happens that your insurance does not cover, you may need to pay for some expenses out of pocket. |

Comprehensive travel insurance

| Pros: | Cons: |

|---|---|

|

Wide coverage: Includes all essential areas like medical emergencies, cancellations, personal belongings, and high-risk activities. Higher claim limits: Comprehensive policies often provide higher reimbursement limits. Peace of mind: Offers more extensive protection, which allows you to travel with fewer worries. |

Higher cost: Comprehensive policies can be more expensive than basic options. May cover unnecessary areas: You might end up paying for coverage you do not need if your activities are low-risk. |

How to choose the right travel insurance for Bali

Keep a few things in mind when you choose travel insurance for Bali. These include the following factors:

- Length of stay: If you're staying for an extended period, comprehensive insurance may be more suitable.

- Activities planned: If you’re taking part in high-risk activities your policy should specifically cover adventure sports and any related injuries.

- Travel itinerary: If your trip includes multiple destinations, choose a plan that covers all the places you'll visit.

- Budget: Balance the level of coverage with your budget. The extra coverage might be worth it for the peace of mind.

Additional considerations for your Bali travel insurance

- Existing coverage: Some credit cards offer travel insurance as a perk. Check to make sure it provides enough coverage for your Bali trip.

- Pre-existing medical conditions: If you have any pre-existing health conditions, check that your policy covers their treatment while abroad.

- Natural disasters: Double-check that your insurance covers natural disaster-related disruptions like earthquakes and volcanic eruptions.